Press SNAP! Same Song, Different Channel

Original Publisher

Late yesterday, Snap reported its Q3 earnings. This morning, we woke up to alarming headlines noting that Snap shares dropped a whopping 22% due to missing revenue expectations – which is being blamed on the impact of Apple’s iOS tracking restrictions.

After praising Apple’s consumer-friendly changes back in February, Snap CEO Evan Spiegel had this to say in yesterday’s statement: “While we anticipated some degree of business disruption, the new Apple-provided measurement solution did not scale as we had expected, making it more difficult for our advertising partners to measure and manage their ad campaigns for iOS.”

Sound familiar?

While the vast majority of attention has been on Facebook’s measurement woes, the devastation from Apple’s App Tracking Transparency (ATT) and associated policies is not limited to just one platform.

As we mentioned previously, Apple’s policy updates, whether altruistic or a veiled competitive play, are only the first of many changes we anticipate (cookies anyone?) that will continue to restrict data access and force sweeping changes in how advertisers track and measure campaigns. And while Facebook has been in the hot seat, as the 2nd largest ad platform in the world and a critical channel for DTC ecommerce brands, every online ad channel is grappling with the fallout from new policies and increasing privacy-driven limitations.

While I applaud all of the companies and industry organizations tirelessly working to land an alternative/unified identity resolution option that maintains privacy requirements while allowing platforms to continue user-level tracking, Snap and Facebook have made it abundantly clear that we don’t have time to wait.

Marketers cannot afford to stunt business by halting spend on these channels until the industry finds a way to sort itself out. The truth is, if these channels were performing well before iOS 14.5, then they are likely still providing value now. Brands can feel it. Performance isn’t failing, measurement is.

Fortunately, there is a solution. And, if you’re at all tapped into the advertising world, you’ve been hearing about it a lot lately.

Incrementality testing and experiments.

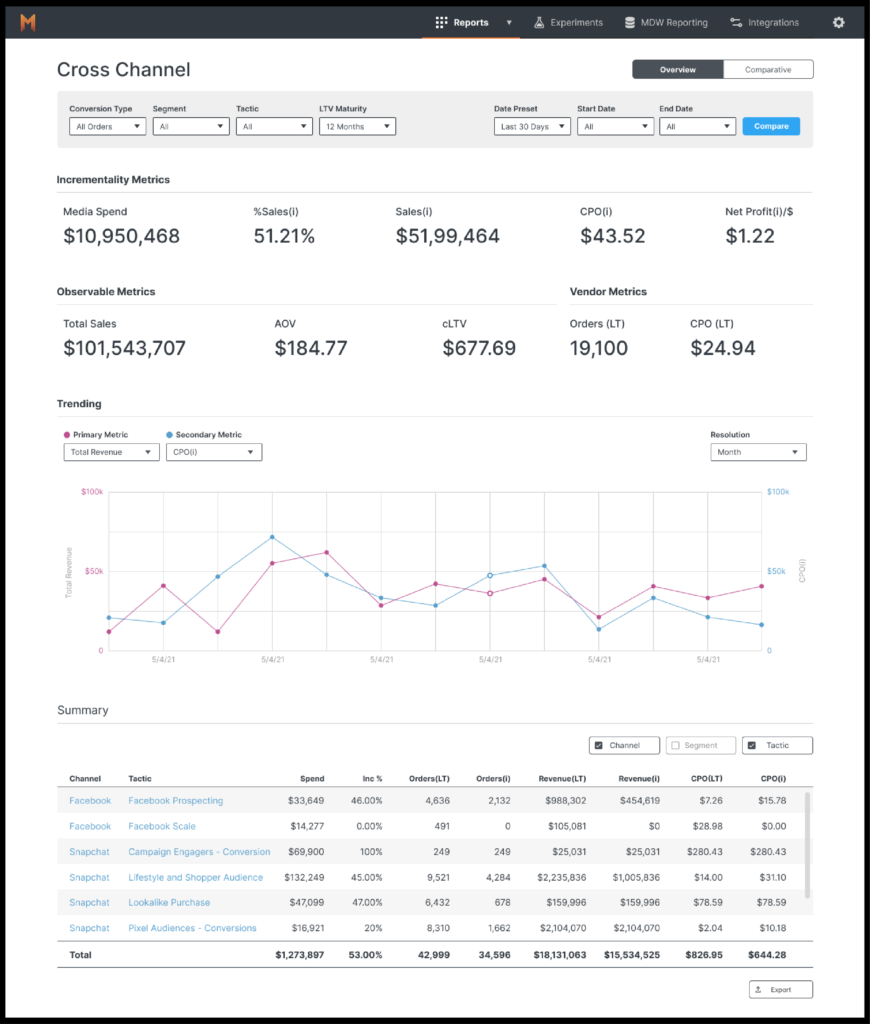

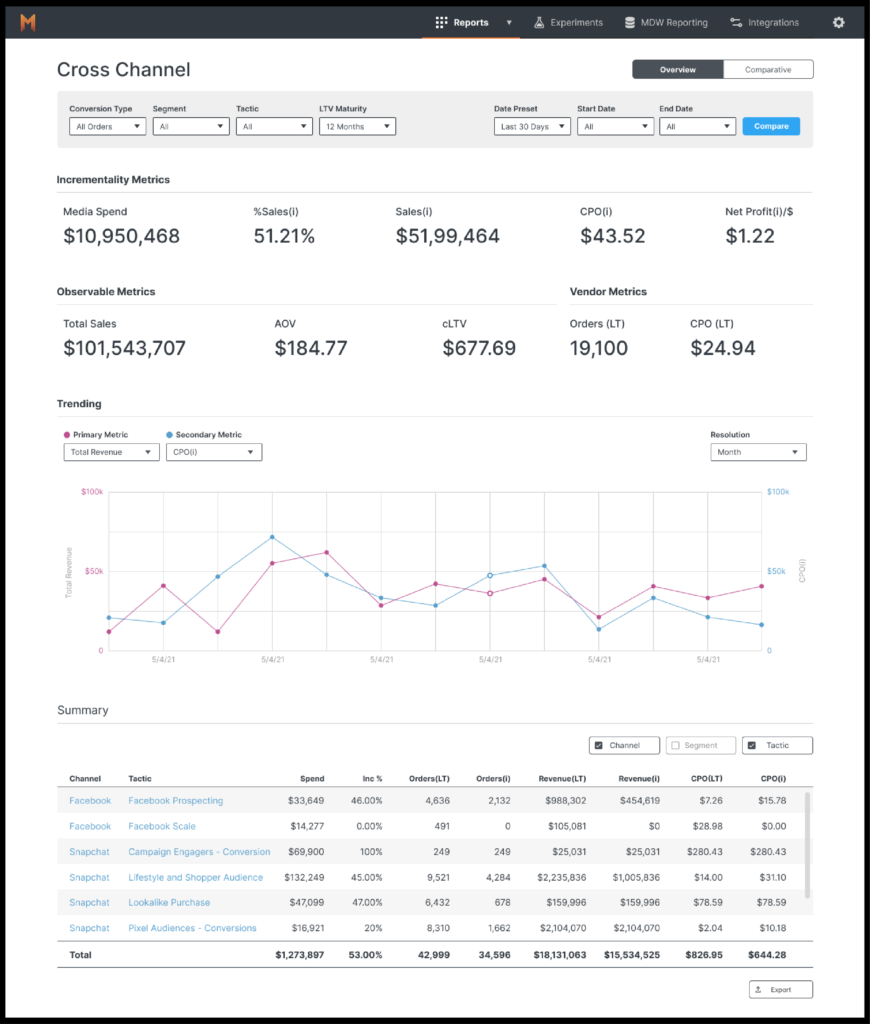

Designed and executed correctly, independent experiments can provide insight into media incrementality at channel, campaign, and ad set levels – on any platform. By measuring the true incremental contribution of media, anchored on source-of-truth transaction data provided by the brand, marketers can make informed decisions about budget allocation – even amid rising concerns about the reliability of platform self-reporting.

We’ve worked with many brands to run unbiased experiments on Snap, Facebook, TikTok, and a host of other popular platforms. They are using the results to confidently keep advertising on these channels where they know their prospects are spending time.

We developed our methodologies and experiment designs in anticipation of this very moment. We offer experimentation, like geo-testing or split-audience testing using CRM file data, that are based on first-party data and don’t rely on questionable reporting from the platforms. By mapping to your ecommerce transaction data, we ensure the results and recommended actions reported are always reliable.

Measured is committed to being the measurement provider brands can trust for technology solutions and expert advice to grow in this new, privacy-led era of advertising. Don’t let the noise and chaos around you distract you from reaching your objectives.

You can keep growing, confidently, and get the data you need to prove it.

Request a Demo

Designed and executed correctly, independent experiments can provide insight into media incrementality at channel, campaign, and ad set levels - on any platform.

SNAP! Same Song, Different Channel

This was originally published onLate yesterday, Snap reported its Q3 earnings. This morning, we woke up to alarming headlines noting that Snap shares dropped a whopping 22% due to missing revenue expectations – which is being blamed on the impact of Apple’s iOS tracking restrictions.

After praising Apple’s consumer-friendly changes back in February, Snap CEO Evan Spiegel had this to say in yesterday’s statement: “While we anticipated some degree of business disruption, the new Apple-provided measurement solution did not scale as we had expected, making it more difficult for our advertising partners to measure and manage their ad campaigns for iOS.”

Sound familiar?

While the vast majority of attention has been on Facebook’s measurement woes, the devastation from Apple’s App Tracking Transparency (ATT) and associated policies is not limited to just one platform.

As we mentioned previously, Apple’s policy updates, whether altruistic or a veiled competitive play, are only the first of many changes we anticipate (cookies anyone?) that will continue to restrict data access and force sweeping changes in how advertisers track and measure campaigns. And while Facebook has been in the hot seat, as the 2nd largest ad platform in the world and a critical channel for DTC ecommerce brands, every online ad channel is grappling with the fallout from new policies and increasing privacy-driven limitations.

While I applaud all of the companies and industry organizations tirelessly working to land an alternative/unified identity resolution option that maintains privacy requirements while allowing platforms to continue user-level tracking, Snap and Facebook have made it abundantly clear that we don’t have time to wait.

Marketers cannot afford to stunt business by halting spend on these channels until the industry finds a way to sort itself out. The truth is, if these channels were performing well before iOS 14.5, then they are likely still providing value now. Brands can feel it. Performance isn’t failing, measurement is.

Fortunately, there is a solution. And, if you’re at all tapped into the advertising world, you’ve been hearing about it a lot lately.

Incrementality testing and experiments.

Designed and executed correctly, independent experiments can provide insight into media incrementality at channel, campaign, and ad set levels – on any platform. By measuring the true incremental contribution of media, anchored on source-of-truth transaction data provided by the brand, marketers can make informed decisions about budget allocation – even amid rising concerns about the reliability of platform self-reporting.

We’ve worked with many brands to run unbiased experiments on Snap, Facebook, TikTok, and a host of other popular platforms. They are using the results to confidently keep advertising on these channels where they know their prospects are spending time.

We developed our methodologies and experiment designs in anticipation of this very moment. We offer experimentation, like geo-testing or split-audience testing using CRM file data, that are based on first-party data and don’t rely on questionable reporting from the platforms. By mapping to your ecommerce transaction data, we ensure the results and recommended actions reported are always reliable.

Measured is committed to being the measurement provider brands can trust for technology solutions and expert advice to grow in this new, privacy-led era of advertising. Don’t let the noise and chaos around you distract you from reaching your objectives.

You can keep growing, confidently, and get the data you need to prove it.

Request a Demo

Original Publisher

Designed and executed correctly, independent experiments can provide insight into media incrementality at channel, campaign, and ad set levels - on any platform.

Ready to see how trusted measurement can help your brand make smarter media decisions?

Get a Demo

Get a Demo

Talk to Us!

Learn how our incrementality measurement drives smarter cross-channel media investment decisions.

Press Marketers: We Can Tell You What’s Happening With Your Facebook Ads

Original Publisher

Marketers: We Can Tell You What’s Happening With Your Facebook Ads

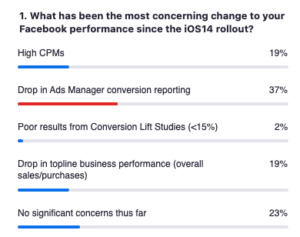

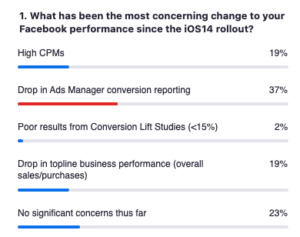

This was originally published onFacebook is making a lot of headlines right now – for a lot of reasons. Advertisers have been seeing up to a 40-50 percent drop in platform-reported conversion rates since the rollout of Apple’s iOS 14.5. As if that wasn’t enough to sound the alarm for marketers, the brand is wrapped up in ongoing high-profile scandals, making it impossible for the advertising giant to break out of the negative news cycles.

As some vocal critics call for brands and consumers alike to stop spending time or money on the platform, advertisers are beginning to contemplate whether they should consider reallocating budgets to other channels. It’s a difficult decision to make, especially for many growing DTC brands that built their online businesses on the backbone of the second-largest advertising platform in the world. For marketers who spend a significant portion of their budget and acquire the vast majority of their customers on Facebook, moving money away from the tried-and-true platform to untested channels could have disastrous business ramifications.

Marketers need all the information they can get to make the calls that will best serve the needs of their business. Here’s what we know right now:

- Due to the impact of Apple’s data and tracking restrictions, Facebook’s measurement and reporting systems are broken. Less data, and smaller windows of time to collect it, will always result in fewer results.

- While Facebook attribution is reporting a significant drop in conversions, advertising performance has actually remained consistent compared to pre-iOS 14.5 contribution levels. We ran the incrementality tests. We’ve seen the data.

- Marketers who rely on platform reporting to make decisions about advertising are flying blind right now. Many marketers can sense that their Facebook ads are still working because the sales are still coming in, but proving it in the current environment is a difficult task.

We can help.

Whether a marketer just needs clarity on how their Facebook investments are contributing to ROAS or they want actionable insight into how they can safely diversify and reallocate budgets without stunting growth, unbiased experiment designs from Measured will deliver trusted incrementality insights and reliable reporting to light the way.

Today we announced the industry’s first end-to-end incrementality measurement and reporting solution for Facebook advertising in a post-iOS 14.5 world. Our independent experiments provide ongoing insights into Facebook incrementality at channel, campaign, and ad set levels. By measuring the true incremental contribution of Facebook media, anchored on source-of-truth transaction data provided by the brand, marketers can make informed decisions about budget allocation – even amid rising concerns about the reliability of platform self-reporting.

Measured is committed to being the measurement provider brands can trust for technology solutions and expert advice to grow in this new, privacy-led era of advertising.

We are regularly holding live online sessions to provide marketers with the latest insight as Facebook changes continue to unfold and similar industry events force us all to rethink how we track, measure and act. Check out our most recent session focused on solving Facebook measurement here: https://beta.measured.com/webinar/measured-incrementality-insights-solving-facebook-measurement

For more information about our incrementality measurement solutions for Facebook, read today’s release.

Want to talk to a Measurement expert about your incrementality measurement needs?

Marketers who rely on Facebook platform reporting to make decisions about advertising are flying blind right now. We can help.

Marketers: We Can Tell You What’s Happening With Your Facebook Ads

This was originally published onFacebook is making a lot of headlines right now – for a lot of reasons. Advertisers have been seeing up to a 40-50 percent drop in platform-reported conversion rates since the rollout of Apple’s iOS 14.5. As if that wasn’t enough to sound the alarm for marketers, the brand is wrapped up in ongoing high-profile scandals, making it impossible for the advertising giant to break out of the negative news cycles.

As some vocal critics call for brands and consumers alike to stop spending time or money on the platform, advertisers are beginning to contemplate whether they should consider reallocating budgets to other channels. It’s a difficult decision to make, especially for many growing DTC brands that built their online businesses on the backbone of the second-largest advertising platform in the world. For marketers who spend a significant portion of their budget and acquire the vast majority of their customers on Facebook, moving money away from the tried-and-true platform to untested channels could have disastrous business ramifications.

Marketers need all the information they can get to make the calls that will best serve the needs of their business. Here’s what we know right now:

- Due to the impact of Apple’s data and tracking restrictions, Facebook’s measurement and reporting systems are broken. Less data, and smaller windows of time to collect it, will always result in fewer results.

- While Facebook attribution is reporting a significant drop in conversions, advertising performance has actually remained consistent compared to pre-iOS 14.5 contribution levels. We ran the incrementality tests. We’ve seen the data.

- Marketers who rely on platform reporting to make decisions about advertising are flying blind right now. Many marketers can sense that their Facebook ads are still working because the sales are still coming in, but proving it in the current environment is a difficult task.

We can help.

Whether a marketer just needs clarity on how their Facebook investments are contributing to ROAS or they want actionable insight into how they can safely diversify and reallocate budgets without stunting growth, unbiased experiment designs from Measured will deliver trusted incrementality insights and reliable reporting to light the way.

Today we announced the industry’s first end-to-end incrementality measurement and reporting solution for Facebook advertising in a post-iOS 14.5 world. Our independent experiments provide ongoing insights into Facebook incrementality at channel, campaign, and ad set levels. By measuring the true incremental contribution of Facebook media, anchored on source-of-truth transaction data provided by the brand, marketers can make informed decisions about budget allocation – even amid rising concerns about the reliability of platform self-reporting.

Measured is committed to being the measurement provider brands can trust for technology solutions and expert advice to grow in this new, privacy-led era of advertising.

We are regularly holding live online sessions to provide marketers with the latest insight as Facebook changes continue to unfold and similar industry events force us all to rethink how we track, measure and act. Check out our most recent session focused on solving Facebook measurement here: https://beta.measured.com/webinar/measured-incrementality-insights-solving-facebook-measurement

For more information about our incrementality measurement solutions for Facebook, read today’s release.

Want to talk to a Measurement expert about your incrementality measurement needs?

Original Publisher

Marketers who rely on Facebook platform reporting to make decisions about advertising are flying blind right now. We can help.

Ready to see how trusted measurement can help your brand make smarter media decisions?

Get a Demo

Get a Demo

Talk to Us!

Learn how our incrementality measurement drives smarter cross-channel media investment decisions.

Press It’s Time to Get to Know Geo

Original Publisher

It’s Time to Get to Know Geo

This was originally published onA few months ago, as a steady stream of data policy updates from platforms like Facebook, Apple and Google had marketers feeling less than confident about the future of advertising, we decided to live-stream a discussion with experts to provide some clarity for our clients about the impact of iOS 14.5 on Facebook measurement and performance. The overwhelming response made it clear that brands are hungry for expert insight and tactical guidance for addressing what kept them up last night – not four weeks ago.

Measured is committed to helping brands figure out measurement for continuous data-driven growth, which requires adapting to inevitable and frequent changes that affect our environment.

Things happen fast. Webinars that take two months of planning are no longer relevant and, if we’re being honest, nobody attends for the polished presentations or sales pitch bookends that have become the standard – people show up for useful insight.

In that spirit, we’ve created the Incrementality Insights series. About once a month we’ll conduct a live discussion on a topic you’ve been asking about, led by subject matter experts and drawing on knowledge we’ve uncovered working with ecommerce and media platforms, technology partners, and across our portfolio of brands.

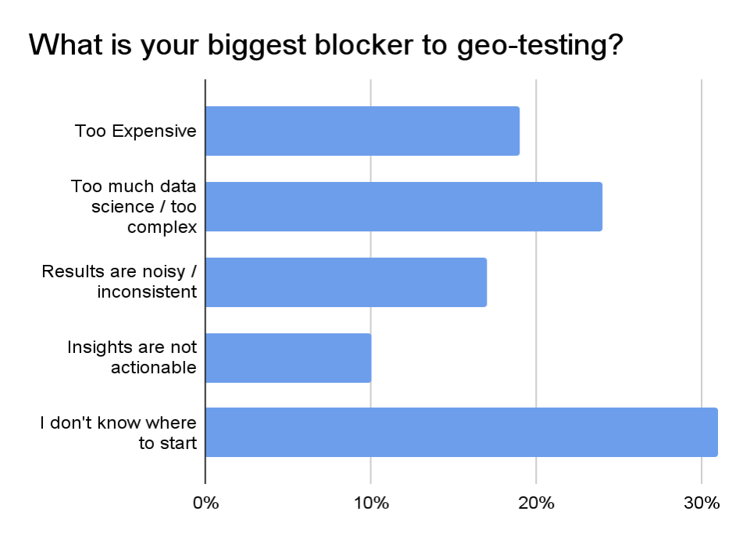

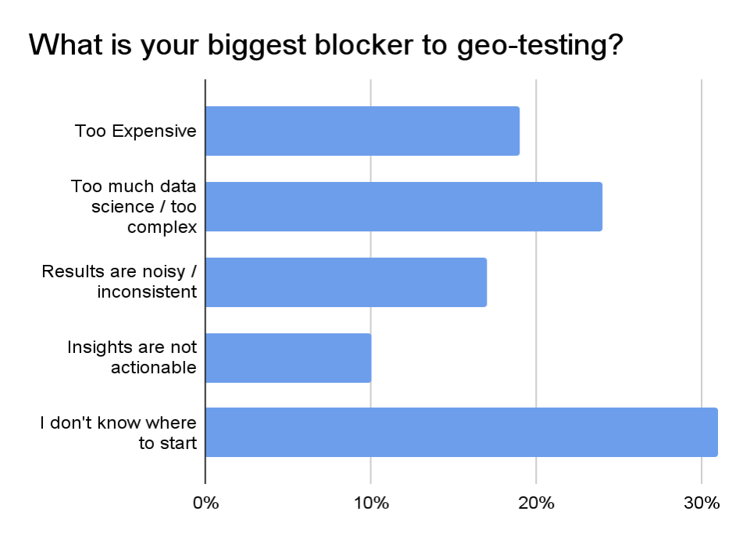

Last week, we tackled the topic of geo experimentation. As user-level tracking and multi-touch attribution are laid to rest, experimentation anchored on 1st party data is the future-proof approach for marketing measurement – and geo-matched market testing is a near-universal approach for measuring incrementality on most media channels, especially for prospecting tactics.

Geo experiments don’t require user-level data, but they can still reveal the incremental contribution of media to any metric that can be collected at the geo level. We’ve heard from some brands that Facebook reps have even recommended running geo-tests to validate results while they work to stabilize reporting after the ripple effects of iOS 14.5 and ATT.

In short, it’s a good time to get to know geo. Watch the video and access the slides from last week for an overview of the methodology, a live demo of geo-experiment design, and a case study showing how one brand used geo-testing to reveal scale potential of YouTube prospecting (they doubled their spend while maintaining target ROAS).

We also had a lively Q&A during the session, which is included below if you’re curious about what your peers are asking.

Want to learn more about geo and incrementality measurement? Read the guide!

| Question | Answer |

| How are conversion attribution windows approached as they vary across platforms? Especially with the iOS 14 impact on Facebook | It essentially represents the denominator in your incrementality percentage calculation. The way we arrive at the number of incremental conversions is independent of in-platform tracking, so you can set the windows however you like. |

| How does the Measured platform determine the list of markets to be included in a test? | We test within a single country, at different geo granularities (State, DMA, City, Zip). The market selection process is based on a correlation analysis driven by a regression model and a ranking process.

This gives us a list of the best test geo-markets to use in your design. |

| What model are you using to predict the conversions? | We have three methods: linear regression, lasso, and flat average. We use the model that comes back with the best result in the A/A analysis. Our most used model is Lasso. |

| What do you use as the source of conversions if not the in-platform tracking? | We’re looking at the change in your actual sales, not in what platforms report. The data comes from your source of truth for transactions, such as your ecommerce platform. |

| This seems like I limited it to large brands that have a large reach across many markets. Is that correct or can you run with only 3-4 markets? Is that recommended? | Smaller brands are actually better suited for tests, since there is a more discernible impact of media on the business. If the brands are limited to certain markets, then they have to take a more granular geo grain for testing like DMA or zip code. |

| Does the market selection model account for other channel spends in-market (mix of national and other geo/local) to control for noise? | Designs are typically deployed to control for certain channels which are being tested. But markets are selected to make sure they are “matched,” meaning the markets being tested on are good candidates to understand “national” impact. |

| So if we heavy up geographically in platform, we can ideally see the outcome in our 1st party data to prove the effect is there? | That’s correct, you can see the scale in your 1st party data in those markets where media heavy up was executed. |

| Given the focus of this webinar on how the marketers can leverage Measured, I am wondering if you can share some insights from your experience on how platforms such as Facebook, Google get involved in this process/partnership – if they do? | We often have marketing sciences representatives from Facebook and Google join discussions about the client’s learning agenda and experiment design considerations. Past that, it’s usually an automated execution. Sometimes they also participate in the interpretation of the results. Generally, they are good partners for clients in navigating the testing agenda. |

| I think you mentioned this is a mid/upper funnel campaign (so may not drive immediate conversion), is the ROAS based on sales/conversions or some sort of intermediary metric like site visitors? | This would be sales/conversions observed within the observation window, some channels have more “tail” past the 30 days, that are not directly measurable. |

| In the YouTube example, how do you account for higher media costs (eCPM) as spend scales? | When the spend gets scaled on the platform on specific markets, CPMs do go up, significantly sometimes, so the marginal CPA/ROAS measured accounts for the CPM environment at higher spend levels. Naturally, auction bidded environments can have more daily fluctuations, but we are looking to understand large scale changes, so the CPM changes can be used directionally. |

| Do you run market tests on other demographic levels than DMAs? E.g. zip codes | We do. Our product can support State-DMA-City-Zip designs. (DMA is US only). |

| One of the challenges out there is that clients in certain verticals (such as CPG) don’t always have access to 1st party conversion data. What is your recommendation/solution (if any) for them if they want to be able to run Geo Lift studies? | Retailer based 3rd party transaction data is challenging. At the very least. You need data available with the state/DMA/zip geo grain in them to enable testing. Else, you are better off using a MMM approach |

| Brands that are CPG focused working with several retailers have several weeks of lag time on sales data reporting. How would you design an experiment for them to account for that lag? | In theory, this wouldn’t hurt our design or read process; it would just take longer for your read to arrive. |

| Is Measured looking at Geo-testing as an alternative to understanding long-term impact of channels/media, in particular for businesses with an extended sales cycle + slow time to convert (generally $1000+ AOV, 1+ months average time to convert)? | Typically, sales that take a really long time to convert, like a car, are not great candidates for geo testing. Consideration cycles under a month are good candidates for geo. |

| Regarding your introductory examples: Isn’t your design too simple because there are cells missing? What about interaction effects between YT and Paid Search (PLA and Paid Brand Search) (i.e., Scale-up & Scale-up vs. Scale-up & Hold-out vs. Hold-up & Scale-up vs. Hold-up & Hold-up)? | We will typically design more cells (this was a quick/simple demo). As Nick mentioned, you can get more creative and sophisticated with the design. It all depends on the business questions you are trying to answer.

On the reporting side, we will also do an analysis on the source/medium to see if there is an interactive effect in the reporting. |

The way we arrive at the number of incremental conversions is based on actual sales from your source of truth, not what the platforms report.

It’s Time to Get to Know Geo

This was originally published onA few months ago, as a steady stream of data policy updates from platforms like Facebook, Apple and Google had marketers feeling less than confident about the future of advertising, we decided to live-stream a discussion with experts to provide some clarity for our clients about the impact of iOS 14.5 on Facebook measurement and performance. The overwhelming response made it clear that brands are hungry for expert insight and tactical guidance for addressing what kept them up last night – not four weeks ago.

Measured is committed to helping brands figure out measurement for continuous data-driven growth, which requires adapting to inevitable and frequent changes that affect our environment.

Things happen fast. Webinars that take two months of planning are no longer relevant and, if we’re being honest, nobody attends for the polished presentations or sales pitch bookends that have become the standard – people show up for useful insight.

In that spirit, we’ve created the Incrementality Insights series. About once a month we’ll conduct a live discussion on a topic you’ve been asking about, led by subject matter experts and drawing on knowledge we’ve uncovered working with ecommerce and media platforms, technology partners, and across our portfolio of brands.

Last week, we tackled the topic of geo experimentation. As user-level tracking and multi-touch attribution are laid to rest, experimentation anchored on 1st party data is the future-proof approach for marketing measurement – and geo-matched market testing is a near-universal approach for measuring incrementality on most media channels, especially for prospecting tactics.

Geo experiments don’t require user-level data, but they can still reveal the incremental contribution of media to any metric that can be collected at the geo level. We’ve heard from some brands that Facebook reps have even recommended running geo-tests to validate results while they work to stabilize reporting after the ripple effects of iOS 14.5 and ATT.

In short, it’s a good time to get to know geo. Watch the video and access the slides from last week for an overview of the methodology, a live demo of geo-experiment design, and a case study showing how one brand used geo-testing to reveal scale potential of YouTube prospecting (they doubled their spend while maintaining target ROAS).

We also had a lively Q&A during the session, which is included below if you’re curious about what your peers are asking.

Want to learn more about geo and incrementality measurement? Read the guide!

| Question | Answer |

| How are conversion attribution windows approached as they vary across platforms? Especially with the iOS 14 impact on Facebook | It essentially represents the denominator in your incrementality percentage calculation. The way we arrive at the number of incremental conversions is independent of in-platform tracking, so you can set the windows however you like. |

| How does the Measured platform determine the list of markets to be included in a test? | We test within a single country, at different geo granularities (State, DMA, City, Zip). The market selection process is based on a correlation analysis driven by a regression model and a ranking process.

This gives us a list of the best test geo-markets to use in your design. |

| What model are you using to predict the conversions? | We have three methods: linear regression, lasso, and flat average. We use the model that comes back with the best result in the A/A analysis. Our most used model is Lasso. |

| What do you use as the source of conversions if not the in-platform tracking? | We’re looking at the change in your actual sales, not in what platforms report. The data comes from your source of truth for transactions, such as your ecommerce platform. |

| This seems like I limited it to large brands that have a large reach across many markets. Is that correct or can you run with only 3-4 markets? Is that recommended? | Smaller brands are actually better suited for tests, since there is a more discernible impact of media on the business. If the brands are limited to certain markets, then they have to take a more granular geo grain for testing like DMA or zip code. |

| Does the market selection model account for other channel spends in-market (mix of national and other geo/local) to control for noise? | Designs are typically deployed to control for certain channels which are being tested. But markets are selected to make sure they are “matched,” meaning the markets being tested on are good candidates to understand “national” impact. |

| So if we heavy up geographically in platform, we can ideally see the outcome in our 1st party data to prove the effect is there? | That’s correct, you can see the scale in your 1st party data in those markets where media heavy up was executed. |

| Given the focus of this webinar on how the marketers can leverage Measured, I am wondering if you can share some insights from your experience on how platforms such as Facebook, Google get involved in this process/partnership – if they do? | We often have marketing sciences representatives from Facebook and Google join discussions about the client’s learning agenda and experiment design considerations. Past that, it’s usually an automated execution. Sometimes they also participate in the interpretation of the results. Generally, they are good partners for clients in navigating the testing agenda. |

| I think you mentioned this is a mid/upper funnel campaign (so may not drive immediate conversion), is the ROAS based on sales/conversions or some sort of intermediary metric like site visitors? | This would be sales/conversions observed within the observation window, some channels have more “tail” past the 30 days, that are not directly measurable. |

| In the YouTube example, how do you account for higher media costs (eCPM) as spend scales? | When the spend gets scaled on the platform on specific markets, CPMs do go up, significantly sometimes, so the marginal CPA/ROAS measured accounts for the CPM environment at higher spend levels. Naturally, auction bidded environments can have more daily fluctuations, but we are looking to understand large scale changes, so the CPM changes can be used directionally. |

| Do you run market tests on other demographic levels than DMAs? E.g. zip codes | We do. Our product can support State-DMA-City-Zip designs. (DMA is US only). |

| One of the challenges out there is that clients in certain verticals (such as CPG) don’t always have access to 1st party conversion data. What is your recommendation/solution (if any) for them if they want to be able to run Geo Lift studies? | Retailer based 3rd party transaction data is challenging. At the very least. You need data available with the state/DMA/zip geo grain in them to enable testing. Else, you are better off using a MMM approach |

| Brands that are CPG focused working with several retailers have several weeks of lag time on sales data reporting. How would you design an experiment for them to account for that lag? | In theory, this wouldn’t hurt our design or read process; it would just take longer for your read to arrive. |

| Is Measured looking at Geo-testing as an alternative to understanding long-term impact of channels/media, in particular for businesses with an extended sales cycle + slow time to convert (generally $1000+ AOV, 1+ months average time to convert)? | Typically, sales that take a really long time to convert, like a car, are not great candidates for geo testing. Consideration cycles under a month are good candidates for geo. |

| Regarding your introductory examples: Isn’t your design too simple because there are cells missing? What about interaction effects between YT and Paid Search (PLA and Paid Brand Search) (i.e., Scale-up & Scale-up vs. Scale-up & Hold-out vs. Hold-up & Scale-up vs. Hold-up & Hold-up)? | We will typically design more cells (this was a quick/simple demo). As Nick mentioned, you can get more creative and sophisticated with the design. It all depends on the business questions you are trying to answer.

On the reporting side, we will also do an analysis on the source/medium to see if there is an interactive effect in the reporting. |

Original Publisher

The way we arrive at the number of incremental conversions is based on actual sales from your source of truth, not what the platforms report.

Ready to see how trusted measurement can help your brand make smarter media decisions?

Get a Demo

Get a Demo

Talk to Us!

Learn how our incrementality measurement drives smarter cross-channel media investment decisions.

Press What the Data Says: Apple, Facebook, Attribution, and Incrementality

Original Publisher

What the Data Says: Apple, Facebook, Attribution, and Incrementality

This was originally published onLast week, Measured streamed a live session to share up-to-the-minute insight into how Facebook attribution and advertising performance has fared as iOS 14.5 adoption gains steam. The overwhelming response made it clear that there is an appetite for more transparency, clarity and informed insight from experts to help marketers navigate the recent upheaval in media and advertising.

At Measured, we are in a unique position to observe in real-time how these ongoing platform and policy changes impact the technology, systems, and data that advertisers rely on to inform their investment decisions. We’re keeping our finger on the pulse of the industry and its critical systems and we’re committed to keeping you well-informed along the way.

Below are the key trends we shared in last week’s live session, and recommendations from our experts for keeping your Facebook media strategy on track while the story continues to unfold.

| Observations | Insights |

| iOS14.5 adoption is picking up |

|

| Facebook lift studies are reporting artificially low lift numbers |

|

| 7day CT conversions will be “modeled” from end of June |

|

| Impact on Targeting |

|

| Recommendations | |

| Measurement Strategy |

|

| Analytics Strategy |

|

| Data Strategy |

|

| Marketing strategy |

|

While it is tempting to breathe a collective sigh of relief after months of data-tracking turmoil, the extended life expectancy of third-party cookies should not be an excuse to go back to business as usual. The latest plot twist from Google is just further evidence that platforms are going to keep evolving their stance on privacy – and marketers cannot afford to take a passive stance.

Instead, brands should leverage this gift of time to collect insights through continued experimentation and develop a future-proof measurement plan that is based on first-party assets and adaptable when faced with inevitable change.

Want more detail about what we’ve observed and how to implement our recommendations? Watch the full webinar on-demand with all the insider details:

Follow us on LinkedIn and Twitter for ongoing insights, guidance and details for our next live update on the latest trends.

Brands should leverage this gift of time to collect insights through continued experimentation and develop a future-proof measurement plan that is based on first-party assets and adaptable when faced with inevitable change.

What the Data Says: Apple, Facebook, Attribution, and Incrementality

This was originally published onLast week, Measured streamed a live session to share up-to-the-minute insight into how Facebook attribution and advertising performance has fared as iOS 14.5 adoption gains steam. The overwhelming response made it clear that there is an appetite for more transparency, clarity and informed insight from experts to help marketers navigate the recent upheaval in media and advertising.

At Measured, we are in a unique position to observe in real-time how these ongoing platform and policy changes impact the technology, systems, and data that advertisers rely on to inform their investment decisions. We’re keeping our finger on the pulse of the industry and its critical systems and we’re committed to keeping you well-informed along the way.

Below are the key trends we shared in last week’s live session, and recommendations from our experts for keeping your Facebook media strategy on track while the story continues to unfold.

| Observations | Insights |

| iOS14.5 adoption is picking up |

|

| Facebook lift studies are reporting artificially low lift numbers |

|

| 7day CT conversions will be “modeled” from end of June |

|

| Impact on Targeting |

|

| Recommendations | |

| Measurement Strategy |

|

| Analytics Strategy |

|

| Data Strategy |

|

| Marketing strategy |

|

While it is tempting to breathe a collective sigh of relief after months of data-tracking turmoil, the extended life expectancy of third-party cookies should not be an excuse to go back to business as usual. The latest plot twist from Google is just further evidence that platforms are going to keep evolving their stance on privacy – and marketers cannot afford to take a passive stance.

Instead, brands should leverage this gift of time to collect insights through continued experimentation and develop a future-proof measurement plan that is based on first-party assets and adaptable when faced with inevitable change.

Want more detail about what we’ve observed and how to implement our recommendations? Watch the full webinar on-demand with all the insider details:

Follow us on LinkedIn and Twitter for ongoing insights, guidance and details for our next live update on the latest trends.

Original Publisher

Brands should leverage this gift of time to collect insights through continued experimentation and develop a future-proof measurement plan that is based on first-party assets and adaptable when faced with inevitable change.

Ready to see how trusted measurement can help your brand make smarter media decisions?

Get a Demo

Get a Demo

Talk to Us!

Learn how our incrementality measurement drives smarter cross-channel media investment decisions.

Press Addressing the Attribution FUD Around iOS 14 and Facebook

Original Publisher

Addressing the Attribution FUD Around iOS 14 and Facebook

This was originally published onWe’ve received a lot of questions from marketers concerned about the impending iOS 14 update from Apple and the potential impact on their ability to measure campaign performance on Facebook. It’s understandable to feel unsettled – Facebook is a significant channel for many consumer brands, some industry influencers are ringing alarm bells, and information about what to expect is confusing and vague.

We’ve got you covered. We built Measured to be agile, anticipating the need to continuously adapt to new regulations and inevitable changes at platforms. Here is a simple explanation (minus the fear, uncertainty and doubt) of how the iOS 14 release might impact campaign measurement on Facebook and how Measured plans to continue supporting our clients by working with what’s available to deliver insight you can use.

From the information we do have, there are several things we can expect as iOS 14 goes live and its associated requirements are enforced. Real-time reporting will not be supported so data could be delayed up to three days. iOS 14 will also proactively offer users the option to deny tracking on their devices. As more people opt out, there could potentially be a decrease in the size of custom and retargeting audiences.

The change that has the most significant impact for measurement and reporting is the new attribution window settings. All new or active ad campaigns will automatically be set at 7-day click-through and 1-day view-through attribution windows. 28-day click-through, 28-day view-through, and 7-day view-through windows will become unavailable.

While these limitations present some new challenges for all of us to manage, they will not diminish our ability to examine results and provide valuable insight into campaign performance. Measured has access to more than four years of historical data that we can use to understand potential conversion discrepancies resulting from the shorter attribution windows. We have also carefully adapted our methodologies to ensure that Measured continues to support our clients on Facebook as these changes start to unfold.

Four Options for Facebook Measurement with Measured

- Split test based incrementality experiments – This approach utilizes the Facebook audience split API to split target audiences into test and control cohorts. In the past we would serve public service announcements (PSAs) to the control group to measure baseline conversion propensity. We expect the shorter attribution windows will hamper the use of PSAs, so Measured is piloting alternative treatments and using the split-based measurements along with systematic lift studies to get both program-level and granular adset-level measurements.

- Split test based scale experiments – To test for scale, Measured utilizes the audience split API to split target audiences into three cohorts – test, control and scale. The ad sets used for the test group are cloned and served to the scale group, but at 2x-3x-4x the spend, to measure the point of audience saturation. The 7-day click /1-day view attribution window reporting will still provide valuable insight into scale potential within these audiences.

- Matched market experiments – Using a matched market method, Measured identifies smaller sibling markets/ geographies that are similar to but cheaper to test in than the larger markets. Audiences are then split into test, control and scale cells to measure incrementality and scale for each channel/tactic. Expected changes from Apple and Facebook will bear no impact on this approach.

In addition to optimizing our experiment designs for the realities of iOS 14, Measured is also helping clients prepare for 3rd party cookie deprecation issues. We now offer full service Facebook Conversion API (CAPI) integrations for clients. The forthcoming platform changes and various responses to them have heightened anxiety in the advertising world and we can only expect more changes as the industry continues to evolve. The team at Measured is committed to delivering the best tools and support to help our clients navigate times of change and uncertainty with confidence and peace of mind.

The change that has the most significant impact for measurement and reporting is the new attribution window settings.

Addressing the Attribution FUD Around iOS 14 and Facebook

This was originally published onWe’ve received a lot of questions from marketers concerned about the impending iOS 14 update from Apple and the potential impact on their ability to measure campaign performance on Facebook. It’s understandable to feel unsettled – Facebook is a significant channel for many consumer brands, some industry influencers are ringing alarm bells, and information about what to expect is confusing and vague.

We’ve got you covered. We built Measured to be agile, anticipating the need to continuously adapt to new regulations and inevitable changes at platforms. Here is a simple explanation (minus the fear, uncertainty and doubt) of how the iOS 14 release might impact campaign measurement on Facebook and how Measured plans to continue supporting our clients by working with what’s available to deliver insight you can use.

From the information we do have, there are several things we can expect as iOS 14 goes live and its associated requirements are enforced. Real-time reporting will not be supported so data could be delayed up to three days. iOS 14 will also proactively offer users the option to deny tracking on their devices. As more people opt out, there could potentially be a decrease in the size of custom and retargeting audiences.

The change that has the most significant impact for measurement and reporting is the new attribution window settings. All new or active ad campaigns will automatically be set at 7-day click-through and 1-day view-through attribution windows. 28-day click-through, 28-day view-through, and 7-day view-through windows will become unavailable.

While these limitations present some new challenges for all of us to manage, they will not diminish our ability to examine results and provide valuable insight into campaign performance. Measured has access to more than four years of historical data that we can use to understand potential conversion discrepancies resulting from the shorter attribution windows. We have also carefully adapted our methodologies to ensure that Measured continues to support our clients on Facebook as these changes start to unfold.

Four Options for Facebook Measurement with Measured

- Split test based incrementality experiments – This approach utilizes the Facebook audience split API to split target audiences into test and control cohorts. In the past we would serve public service announcements (PSAs) to the control group to measure baseline conversion propensity. We expect the shorter attribution windows will hamper the use of PSAs, so Measured is piloting alternative treatments and using the split-based measurements along with systematic lift studies to get both program-level and granular adset-level measurements.

- Split test based scale experiments – To test for scale, Measured utilizes the audience split API to split target audiences into three cohorts – test, control and scale. The ad sets used for the test group are cloned and served to the scale group, but at 2x-3x-4x the spend, to measure the point of audience saturation. The 7-day click /1-day view attribution window reporting will still provide valuable insight into scale potential within these audiences.

- Matched market experiments – Using a matched market method, Measured identifies smaller sibling markets/ geographies that are similar to but cheaper to test in than the larger markets. Audiences are then split into test, control and scale cells to measure incrementality and scale for each channel/tactic. Expected changes from Apple and Facebook will bear no impact on this approach.

In addition to optimizing our experiment designs for the realities of iOS 14, Measured is also helping clients prepare for 3rd party cookie deprecation issues. We now offer full service Facebook Conversion API (CAPI) integrations for clients. The forthcoming platform changes and various responses to them have heightened anxiety in the advertising world and we can only expect more changes as the industry continues to evolve. The team at Measured is committed to delivering the best tools and support to help our clients navigate times of change and uncertainty with confidence and peace of mind.

Original Publisher

The change that has the most significant impact for measurement and reporting is the new attribution window settings.

Ready to see how trusted measurement can help your brand make smarter media decisions?

Get a Demo

Get a Demo

Talk to Us!

Learn how our incrementality measurement drives smarter cross-channel media investment decisions.

Press What is a Data Clean Room?

Original Publisher

What is a Data Clean Room?

This was originally published onA Data Clean Room is a secure, protected environment where PII (Personally Identifiable Information) data is anonymized, processed and stored to be made available for measurement, or data transformations in a privacy-compliant way. The raw PII, is made available to the brand and is only viewable by the brand.

How does a Data Clean Room work?

All user-level first-party data loaded from CRM systems (including historical data) like Salesforce, or ecommerce platforms (such as Shopify, Magento, Epsilon). are loaded into this secure environment. Any other data sources including historical and current transaction data can also made available in the clean room environment for a variety of use cases.

The PII data sent to the clean room is hashed for transmission and once it enters the clean room it is secured and encrypted, protecting it from unauthorized access. Brands have full control over the clean room, while partners can get a feed with hashed PII data as an output. This anonymized data can then be shared in a compliant way with measurement partners like Measured or media/publisher platforms like Facebook and Google.

What’s the benefit of a Data Clean Room?

It is set up by a partner like Measured, but is handed over to the brand to use as a turnkey feature giving complete control of the environment to the brand.

What are some additional privacy features of a Data Clean Room?

A consent management system that captures first-party acceptance of cookies to be added to the environment which assists with adherence to CCPA/ CPRA /GDPR regulations. These consent signals are applied to data in the Clean Room, resulting in enriched data that can be used for measurement, or to pass back to media/publisher platforms.

All in all, the Data Clean Room is a trusted Turnkey Compliance solution that is easy to deploy and maintain within your secure environment for privacy compliance.

Use cases for a Data Clean Room:

- Anonymizing user-level PII data that can be used for measurement

- Automation for upload of offline data to publishers like Facebook for matchback processes

- User-level analysis of customers including LTV reporting

- Cohort level analysis.

- Built-in privacy compliance support for regulations such as CCPA, CPRA and GDPR.

A Data Clean Room allows brands to unlock the value of their customer data in a hassle-free and privacy compliant manner.

What is a Data Clean Room?

This was originally published onA Data Clean Room is a secure, protected environment where PII (Personally Identifiable Information) data is anonymized, processed and stored to be made available for measurement, or data transformations in a privacy-compliant way. The raw PII, is made available to the brand and is only viewable by the brand.

How does a Data Clean Room work?

All user-level first-party data loaded from CRM systems (including historical data) like Salesforce, or ecommerce platforms (such as Shopify, Magento, Epsilon). are loaded into this secure environment. Any other data sources including historical and current transaction data can also made available in the clean room environment for a variety of use cases.

The PII data sent to the clean room is hashed for transmission and once it enters the clean room it is secured and encrypted, protecting it from unauthorized access. Brands have full control over the clean room, while partners can get a feed with hashed PII data as an output. This anonymized data can then be shared in a compliant way with measurement partners like Measured or media/publisher platforms like Facebook and Google.

What’s the benefit of a Data Clean Room?

It is set up by a partner like Measured, but is handed over to the brand to use as a turnkey feature giving complete control of the environment to the brand.

What are some additional privacy features of a Data Clean Room?

A consent management system that captures first-party acceptance of cookies to be added to the environment which assists with adherence to CCPA/ CPRA /GDPR regulations. These consent signals are applied to data in the Clean Room, resulting in enriched data that can be used for measurement, or to pass back to media/publisher platforms.

All in all, the Data Clean Room is a trusted Turnkey Compliance solution that is easy to deploy and maintain within your secure environment for privacy compliance.

Use cases for a Data Clean Room:

- Anonymizing user-level PII data that can be used for measurement

- Automation for upload of offline data to publishers like Facebook for matchback processes

- User-level analysis of customers including LTV reporting

- Cohort level analysis.

- Built-in privacy compliance support for regulations such as CCPA, CPRA and GDPR.

Original Publisher

A Data Clean Room allows brands to unlock the value of their customer data in a hassle-free and privacy compliant manner.

Ready to see how trusted measurement can help your brand make smarter media decisions?

Get a Demo

Get a Demo

Talk to Us!

Learn how our incrementality measurement drives smarter cross-channel media investment decisions.